Startup Tax Essentials for 2025 (Business Opportunities - Other Business Ads)

USAOnlineClassifieds > Business Opportunities > Other Business Ads

Item ID 2966529 in Category: Business Opportunities - Other Business Ads

Startup Tax Essentials for 2025 | |

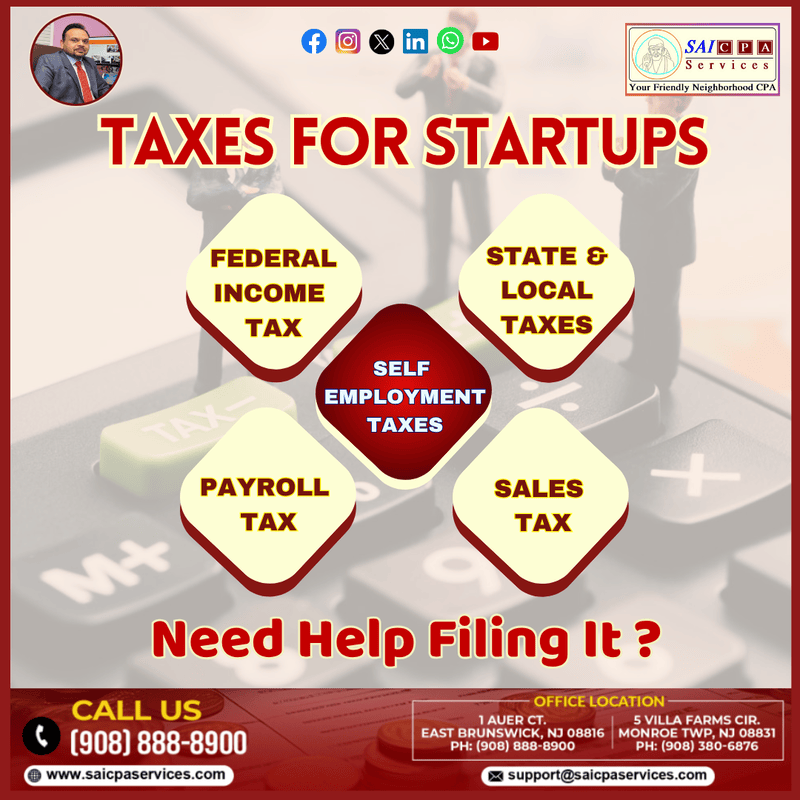

Launching a startup is exciting, but ignoring tax responsibilities can lead to costly surprises. Here are the key taxes every startup must understand to stay compliant and ahead in 2025. 1. Federal Income Tax Every business must report earnings to the IRS. The type of business structure you choose—LLC, S-Corp, or C-Corp—affects how you’re taxed. Sai CPA Services can help you choose the right entity and handle your federal filings with confidence. 2. Self-Employment Tax Startup founders earning profits instead of a salary are typically subject to self-employment tax, which includes Social Security and Medicare contributions. We ensure you're accurately calculating and planning for these costs. 3. Payroll Taxes If you hire employees, you're responsible for withholding income taxes and paying the employer portion of Social Security and Medicare taxes. Sai CPA Services offers reliable payroll tax support to keep you compliant. 4. Sales Tax Selling products or taxable services? You may need to collect and remit state sales tax. Rules vary widely, especially for online and multi-state sales. Our team can help you stay current with state-specific tax laws. 5. State & Local Taxes Your location may require state income tax, franchise tax, or local business taxes. Sai CPA Services helps you understand and meet all your state and local tax obligations. Pro Tip: Partnering with Sai CPA Services ensures your startup is tax-ready, compliant, and financially organized—so you can focus on growth with peace of mind. Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #SaiCPAService #StartupTaxes #NewBusiness #SmallBizFinance #TaxReady #EntrepreneurLife #AccountingMatters #SmartStartups  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : May 29, 2025 2:10 PM Number of Views: 113 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USAOnlineClassifieds > Business Opportunities > Other Business Ads

© 2025 USAOnlineClassifieds.com

USNetAds.com | GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com

2025-11-03 (0.597 sec)